India’s OTT landscape is a battlefield where giants rise, alliances form, and once-thriving platforms vanish into obscurity. From the game-changing JioCinema-Disney+ Hotstar merger to the fall of pioneers like ALTBalaji and MX Player’s surprising Amazon acquisition, the industry is in constant flux. As regional content, sports streaming, and bundled subscriptions dominate the scene, smaller players struggle to survive in this cutthroat race. What led to the collapse of platforms like Voot and BigFlix? How are Airtel Xstream and JioCinema reshaping the future of entertainment? Dive into the dramatic evolution of India’s OTT ecosystem and discover who’s winning the streaming wars.

JioHotstar (JioCinema + Disney+ Hotstar)

- Merger Details: Reliance’s JioCinema and Disney+ Hotstar merged to form JioHotstar under the JioStar umbrella, a joint venture between Reliance and Disney-Star.

- Impact: This created India’s largest OTT platform with over 50 crore users and 3 lakh hours of content. It offers a mix of Hollywood, regional, and sports content, including IPL, ICC events, and more.

- Subscription Model: Free access to most content for limited hours monthly, with premium plans starting at ₹149.

Sony-Zee Merger (Failed)

- Details: Sony Pictures Networks India and Zee Entertainment had planned a $10 billion merger to create a media giant. However, the deal fell apart in early 2024 due to leadership disputes and regulatory challenges.

- Impact: Zee and Sony remain independent players, with Sony focusing on sports and Zee on regional and family-centric content.

Airtel Xstream Partnerships

- Details: Airtel Xstream, Airtel’s OTT aggregator, has partnered with platforms like SonyLIV, Lionsgate Play, and Eros Now to offer bundled content.

- Impact: While not a merger, Airtel Xstream acts as a hub for multiple OTTs, providing users with a consolidated subscription model.

Amazon-MX Player Merger

- Details: Amazon acquired MX Player from Times Internet for over $100 million and merged it with its free ad-supported miniTV platform.

- Impact: This expanded Amazon’s reach into regional and mass-market audiences, offering popular Indian shows and dubbed international content.

Viacom18 and Reliance-Disney Merger

- Details: Viacom18 (owned by Reliance) and Disney-Star merged to form JioStar, consolidating 120 TV channels and two major OTT platforms (JioCinema and Disney+ Hotstar).

- Impact: This merger gave JioStar a 60% market share in India’s media and entertainment industry, with a focus on sports and premium content.

Saregama and Pocket Aces

- Details: Saregama acquired a 51.8% stake in Pocket Aces, a digital content creator known for platforms like FilterCopy and Dice Media.

- Impact: This strengthened Saregama’s digital presence and targeted younger audiences with web series and influencer-driven content.

ENIL and Gaana

- Details: Entertainment Network India Limited (ENIL), which operates Radio Mirchi, acquired Gaana, a music streaming platform.

- Impact: This merger aimed to consolidate music streaming and radio audiences under one umbrella.

Serene Productions and Dharma Productions

- Details: Adar Poonawalla’s Serene Productions acquired a 50% stake in Karan Johar’s Dharma Productions.

- Impact: This partnership focused on leveraging technology to create and distribute high-quality content for digital platforms.

These mergers and partnerships highlight the intense competition in India’s OTT space, with players consolidating to capture larger audiences, diversify content, and compete with global giants like Netflix and Amazon Prime. The focus is increasingly on regional content, sports, and innovative subscription models to cater to India’s diverse audience.

India’s OTT market has been a battleground for years, with some platforms thriving while others failed to keep up with the competition. Here’s a look at the OTT platforms that are no longer around or have been absorbed into larger entities:

1. Voot (Merged into JioCinema)

- What Happened: Voot, owned by Viacom18, was a popular platform offering shows from Colors TV, regional content, and originals. However, after Reliance’s Viacom18 acquired IPL streaming rights, Voot’s content was integrated into JioCinema in 2023.

- Impact: Voot ceased to exist as a standalone platform, and its content library, including originals like Asur and The Gone Game, became part of JioCinema.

2. MX Player (Acquired by Amazon)

- What Happened: MX Player, once a dominant free OTT platform with a massive user base, was sold by Times Internet to Amazon in 2023 for over $100 million. It was merged with Amazon’s free ad-supported miniTV platform.

- Impact: MX Player’s original shows like Aashram and Flames were absorbed into Amazon’s ecosystem, and the standalone MX Player app was discontinued.

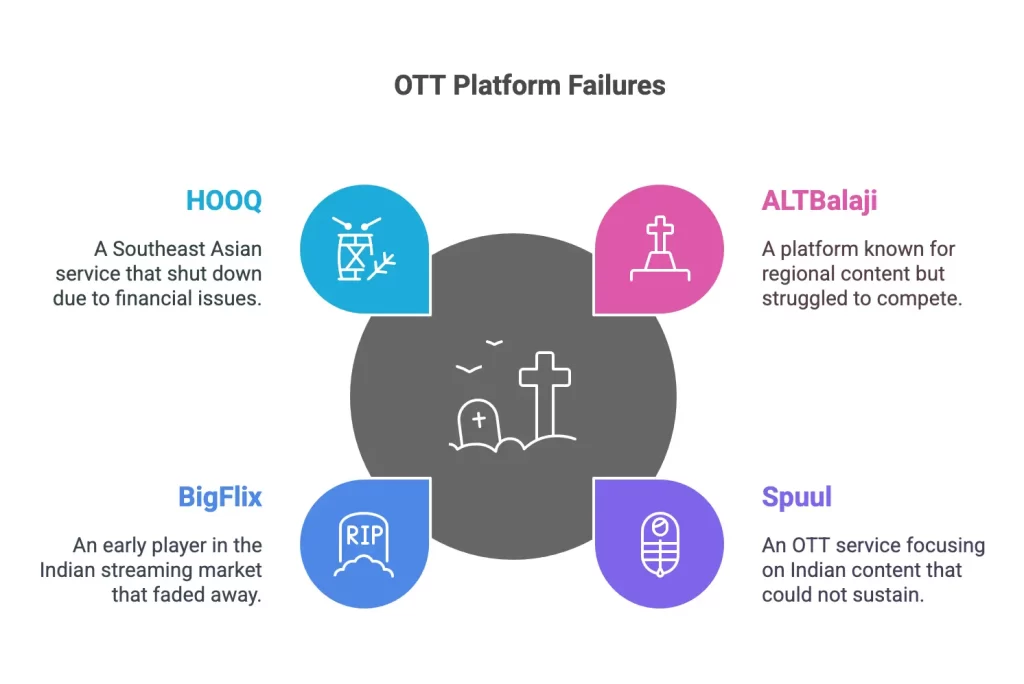

3. ALTBalaji (Phased Out)

- What Happened: ALTBalaji, Balaji Telefilms’ OTT platform, struggled to maintain its user base despite its focus on bold, mass-market content. By 2023, it had significantly scaled down operations and stopped producing new content.

- Impact: Its existing library, including shows like Gandii Baat and Broken But Beautiful, was licensed to other platforms like ZEE5 and JioCinema.

4. HOOQ (Shut Down)

- What Happened: HOOQ, a joint venture between Singtel, Sony Pictures, and Warner Bros., entered India in 2015 but shut down globally in 2020 due to financial struggles.

- Impact: HOOQ’s closure left a gap in the market for Hollywood content, which was quickly filled by platforms like Netflix, Amazon Prime, and Disney+ Hotstar.

5. TVFPlay (Shifted Focus)

- What Happened: TVFPlay, the streaming platform of The Viral Fever (TVF), was an early pioneer in India’s OTT space. However, it struggled to compete with larger players and shifted its focus to licensing its content to platforms like Amazon Prime Video and Netflix.

- Impact: TVFPlay still exists but is no longer a major player in the OTT market. Its popular shows like Pitchers and Kota Factory are now primarily available on other platforms.

6. BigFlix (Discontinued)

- What Happened: Launched by Reliance Entertainment in 2008, BigFlix was one of India’s first OTT platforms. However, it failed to adapt to the changing market and was quietly discontinued.

- Impact: BigFlix’s failure highlighted the importance of evolving with user preferences and offering competitive pricing and content.

7. Eros Now (Merged into Airtel Xstream)

- What Happened: Eros Now, known for its Bollywood library, struggled to maintain relevance in a crowded market. By 2024, it was integrated into Airtel Xstream as part of a partnership.

- Impact: Eros Now’s standalone app lost prominence, and its content became part of Airtel’s bundled offerings.

8. SonyLIV (Struggling Post Sony-Zee Merger Collapse)

- What Happened: While SonyLIV is still operational, it has been struggling to maintain its position after the Sony-Zee merger fell apart. Its focus on sports and niche content hasn’t been enough to compete with giants like JioCinema and Netflix.

- Impact: SonyLIV’s future remains uncertain, and it may eventually merge with another platform or pivot its strategy.

9. Spuul (Discontinued)

- What Happened: Spuul, an early OTT platform targeting Indian expats, failed to keep up with the competition and was quietly discontinued.

- Impact: Its closure reflected the challenges of catering to niche audiences without a strong content pipeline or marketing strategy.

10. YuppTV Originals (Scaled Down)

- What Happened: YuppTV, primarily a live TV streaming service, ventured into originals but failed to gain traction. It has since scaled down its OTT ambitions and focuses on live TV and regional content.

- Impact: YuppTV remains active but is no longer a significant player in the OTT originals space.

Key Takeaways

The OTT market in India is fiercely competitive, and platforms that failed to innovate, adapt, or secure strong content pipelines have either shut down or been absorbed by larger players. The rise of aggregators like JioCinema and Airtel Xstream has further consolidated the market, leaving little room for smaller or niche platforms to survive.