Fifty million Indians lost life insurance coverage in 2025—the largest single-year drop on record—as the country’s insurance industry faces an unprecedented crisis driven by microfinance sector collapse and rising claim denials.

India’s insurance sector is experiencing its most severe contraction in decades, with catastrophic implications for millions of families who thought they were protected. The crisis stems not from external shocks like pandemics or economic downturns, but from fundamental structural problems within the industry itself.

The Shocking Numbers

The scale of the coverage loss is staggering. India’s top four private life insurers—HDFC Life, SBI Life, ICICI Prudential, and Bajaj Allianz—saw their combined group policy coverage plummet from 179 million lives in FY24 to just 128 million in FY25. This repres ents a 25% decline in a single year, affecting roughly one in five Indian households previously covered under these schemes.

HDFC Life alone saw coverage drop from 65 million to 48 million people, while SBI Life experienced a 36% year-on-year decline to 23 million lives covered. The total premium impact was equally severe—HDFC Life’s group business premiums fell 25% to ₹8,970 crore, while SBI Life’s dropped 30% to ₹10,640 crore.

The Microfinance Meltdown

The primary driver of this collapse is the implosion of group credit life insurance, a product typically bundled with microfinance loans. When a borrower takes a ₹30,000 loan from a microfinance institution, it often comes with automatic life coverage that protects both the family and lender if the borrower dies.

But as defaults soared and lenders retreated from the microfinance sector, insurers followed suit. Total microfinance loan disbursals declined 25% in FY25 to ₹1.12 lakh crore, creating a cascading effect that wiped out insurance coverage for millions of low-income families who could least afford to lose protection.

“The high-risk borrower pools and increasing claims have made it difficult to sustain large-scale credit life portfolios,” an industry official told Moneycontrol.

Industry Opacity Masks Deeper Problems

Investment expert Sridhar Sivaram of Enam Holdings has been warning about these issues for years. “I remain bearish on insurance for the simple reason that this is a very opaque industry,” he told NDTV Profit. “Nothing that they disclose are actual numbers. Everything is an estimate. Embedded value is an estimate. Their profits are an estimate… nothing is real.”

His skepticism appears justified. While insurers celebrated modest 5% premium growth in FY2545, the underlying fundamentals tell a different story. The number of life insurance policies sold dropped 7.4% to 270 million in FY25, indicating that growth came primarily from higher premiums on fewer policies rather than expanded coverage.

Health Insurance Crisis Deepens

The problems extend beyond life insurance. Health insurers rejected claims worth ₹26,000 crore in FY24, a 19% increase over the previous year. According to IRDAI data, 11% of all health insurance claims were denied, with another 6% stuck in limbo.

A LocalCircles survey covering over 100,000 respondents found that nearly half of people who filed health insurance claims in the past three years faced serious issues—outright rejections, partial approvals, or discharge delays. Even more concerning, 60% of patients had to wait 6-48 hours for cashless discharge despite IRDAI guidelines requiring one-hour settlements.

What Policyholders Can Do Now

Choose Insurers Wisely

Based on 2023-24 IRDAI data, the best-performing life insurers by claim settlement ratio are:

Max Life Insurance: 99.51% settlement ratio

HDFC Life: 99.39% settlement ratio

Aegon Life: 99.37% settlement ratio

Bharti Axa Life: 99.09% settlement ratio

Bajaj Allianz Life: 99.04% settlement ratio

For health insurance, avoid companies with high rejection rates like Star Health (18.5% rejection rate) and Tata AIG (13% overall rejection rate).

Policies to Avoid

Group Credit Life Insurance: These volatile, low-value policies tied to loans offer minimal protection and can disappear overnight when lending slows.

Endowment Plans: These investment-insurance hybrids provide poor returns on both fronts. Pure term insurance offers much higher coverage at lower premiums.

High-Fee ULIPs: Unit-linked plans often carry heavy charges that erode returns, especially after recent regulatory changes.

When Claims Get Denied

The appeal process can be surprisingly effective—research shows 39.5% of denied health claims are overturned on appeal. Here’s the step-by-step process:

Contact the insurer’s grievance cell (must respond within 14 days)

File with IRDAI via Bima Bharosa portal or call 155255

Approach the Insurance Ombudsman (can award up to ₹30 lakhs compensation)

Consider consumer courts if other avenues fail

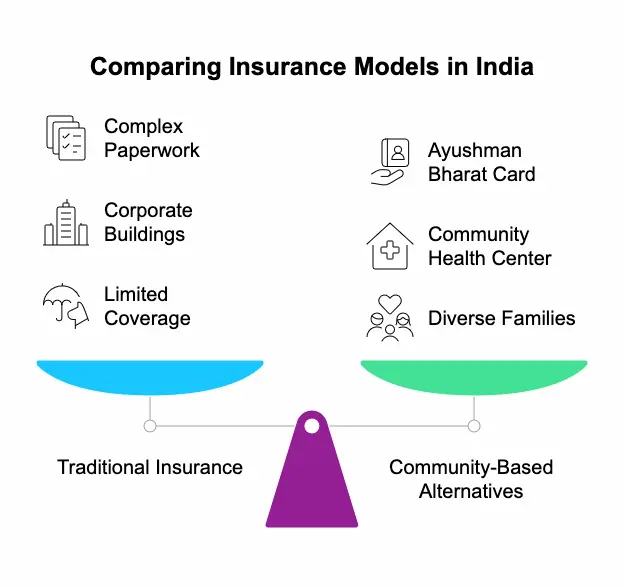

Alternative Protection Strategies

Don’t rely solely on private insurance:

Government Schemes: Ayushman Bharat PMJAY provides ₹5 lakh coverage per family annually, recently extended to all citizens over 70 regardless of income.

Health Savings Accounts: Several banks now offer medical savings accounts with tax benefits and higher interest rates than regular savings.

Community Insurance: Mutual and cooperative insurers cover 3.5 million+ people with 60-85% claim ratios and very low rejection rates.

Emergency Funds: Build a dedicated medical emergency fund equivalent to 6-12 months of expenses.

The Bigger Picture

This crisis reflects deeper structural problems in Indian insurance. While premium growth looks healthy on the surface, it’s built on a foundation of fewer policies, higher prices, and increased claim denials. The collapse of group credit life insurance may have removed 50 million names from coverage rolls, but it also exposed an industry more focused on financial engineering than genuine protection.

For millions of Indian families, the lesson is clear: traditional insurance alone is no longer sufficient. Building resilient financial protection requires diversification across government schemes, community insurance, personal savings, and carefully selected private policies from insurers with proven track records.

The industry’s opacity that Sivaram warned about has real consequences. When everything is an “estimate,” the only certainty is that policyholders can’t rely on promises alone. They need backup plans.